Keep an Eye on Fixed Costs on the Farm

Stay focused with these three strategies as production costs increase.

It’s no secret that production costs will be significantly higher for the 2023 growing season. In the Midwest, the cost of raising a bushel of corn will exceed $5.50 per bushel next year, up from just $3.97 in 2020. Fertilizer remains an enormous source of the upturn, but pressure comes from nearly every budget line item.

Producers usually don’t have much flexibility to offset rising expenses. However, these three strategies help producers progress toward long-term goals despite higher costs.

#1. Be Aware of Availability Bias

Because readily accessible prices have an outsized impact on our thinking, most of us notice rapid cost changes quickly. For example, gasoline prices are posted on signs and updated daily. Prices for other goods and services, such as mowing your lawn or getting a haircut, aren’t nearly as visible. This is known as “availability bias” and occurs when the most readily available data impact perceptions. It’s no surprise managers often focus on categories with readily available prices.

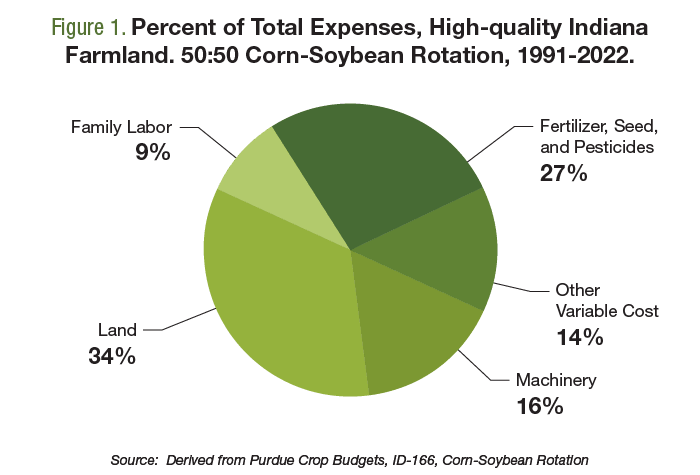

Figure 1 shows the allocation of total production expenses, averaged back to 1991, for a 50:50 corn and soybean rotation in Indiana. Consider the fertilizer, seed, and pesticides category which accounted for 27% of total production expenses. The size of this slice undoubtedly varies from year-to-year and looks different in corn than in soybeans, but the idea is that farm managers may spend considerably more than 27% of their attention on these expenses.

#2. Mind Fixed Expenses

The left side of figure 1 shows the fixed expenses: family labor, land, and machinery. Collectively, these expenses account for the majority cost (59%) of raising corn and soybeans and present a few unique management challenges.

First, prices for family labor, land, and machinery don’t typically post and update regularly. For instance, a farm’s annual machinery expense is the depreciation, interest, repairs, taxes and insurance expenses of several pieces of equipment utilized over several years.

Second, fixed costs are challenging to calculate, measure accurately and incorporate into budgets. These costs may be predictable two or three years out, but initially measurement is challenging.

Third, fixed expenses can be tough to adjust lower in the short run. For example, a three-year cash rental agreement signed when corn is $7 per bushel will take years to renegotiate if corn prices suddenly change.

#3. Consider a Long-run Strategy

Producers know that those with the lowest cost accrue significant advantages in the long run. In other words, those with the lowest per-bushel cost are usually the most profitable. So the question is “how can producers create and maintain a long-run cost advantage?”

It’s important to sharpen the pencil across every category, but in most cases producers find the greatest differentiation and cost advantage within fixed costs. Alternatively, fixed costs tend to create long-term disadvantages.

Availability bias tempts producers to pursue a 5% – 10% advantage on variable expenses, while potentially overlooking more significant opportunities in fixed expenses. In addition to being a large share of total expenses, fixed expenses may offer a greater chance to find a 15% – 20% cost advantage.

Wrapping It Up

The allocation of costs looks slightly different for each commodity, but management implications are consistent. First, availability bias is a powerful force often focusing attention on variable expenses. Second, fixed costs are difficult to track but important to monitor in periods of rising prices. It can take several years to lower fixed costs if they get too high. Finally, producers should examine all categories to create and maintain long-term cost advantages. Often, it’s the categories that are hardest to measure and benchmark – such as machinery or family labor – that provide the biggest source of opportunity.

David and Brent are the co-founders of Ag Economic Insights (AEI.ag). Founded in 2014, AEI.ag helps improve producers, lenders, and agribusiness decision-making through 1) the free Weekly Insights blog, 2) the award-winning AEI.ag Presents podcast – featuring Escaping 1980 and Corn Saves America, and 3) the AEI Premium platform, which includes the Ag Forecast Network decision tool. Visit AEI.ag or email David (david@aei.ag) to learn more. Stay curious.

3 Min Read

- Most people focus on costs with clearly visible prices over obscure expenses.

- The prices of many fixed costs are difficult to calculate.

- The greatest cost advantages are often found within fixed costs.