White mold is one of the most prevalent disease threats to peanut growers across the Southeast. Without proper preventive treatment, this disease can damage roots and pegs, leading to reduced yield potential.

White mold is one of the most consistently damaging soil disease affecting peanuts in South Carolina and across the Southeast. White mold thrives in high soil temperatures and high humidity, making the Southeast an ideal climate for the disease.

Infection often begins underground, damaging pegs and pods early in the season. If left untreated, white mold can rot pods and pegs and cause root decay as the disease progresses.

Delays in planting, lack of rainfall and unusually hot temperatures favor white mold. The namesake symptom is a white, filmy substance on leaves, but the disease also leaves brown rot on limbs or shoots and brown lesions on stems and shoots. Early season intervention is the best defense against white mold damage in peanuts.

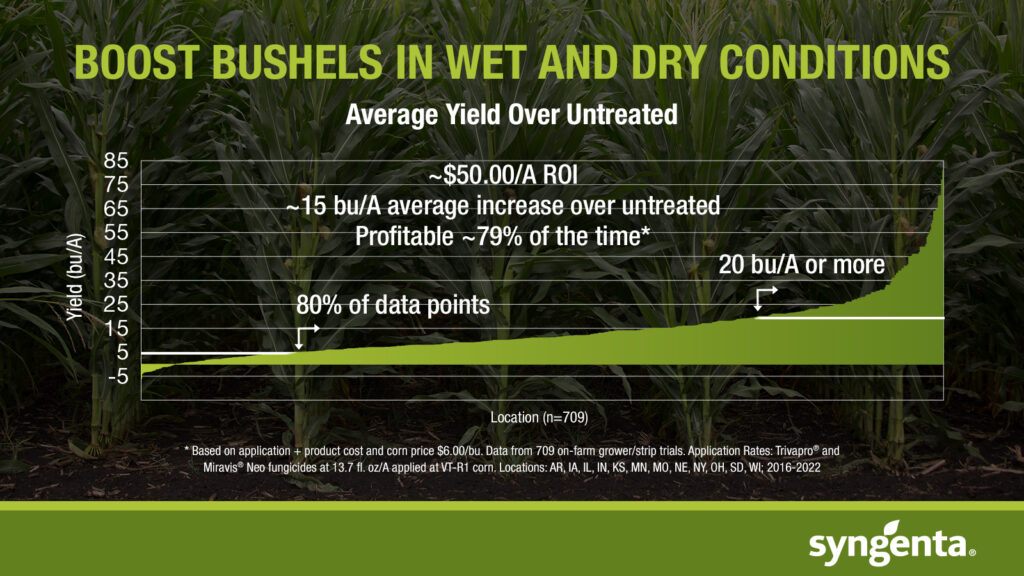

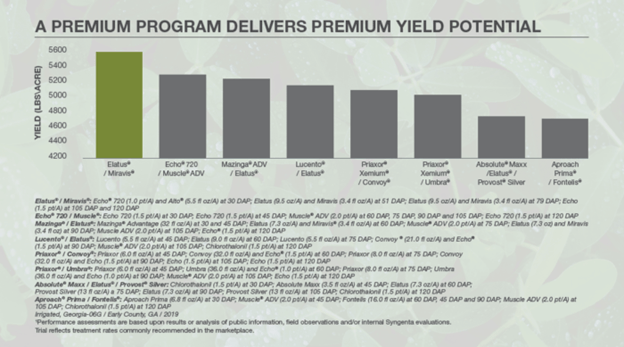

Elatus® fungicide delivers long-lasting protection against white mold in peanuts even under extreme disease pressure. Active ingredients azoxtstrobin and SOLATENOL® fungicide deliver excellent soilborne disease control and up to 28 days of white mold control in peanuts.

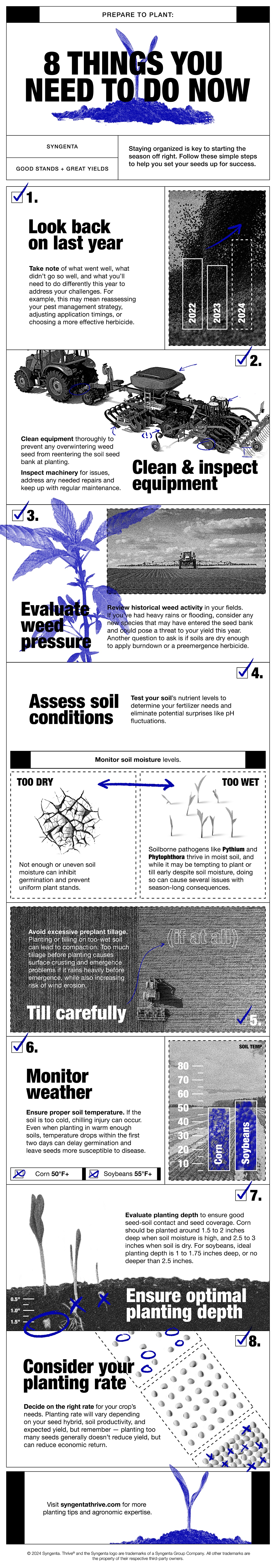

The ideal application timing for optimal white mold control is at 60 and 90 days after planting because most pod damage occurs during this window. Focus on even coverage when spraying Elatus and other peanut fungicides to deliver the most comprehensive disease control and long-lasting protection.

The extended residual control in Elatus offers application flexibility and peace of mind when weather conditions or busy schedules prevent timely application. According to the Wilson Faircloth, Ph.D., the Syngenta Peanut Doctor, Elatus delivers dependable white mold control and is considered the backbone of a successful fungicide program.

To learn more about Elatus, contact your local Syngenta sales representative.