How High Are Cash Rental Rates?

Viewing rental rates in a vacuum may not capture the entire story.

Tight grain stocks, high commodity prices and strong farm income direct much attention to soaring farmland values and the rising production cost. At the intersection of farmland and production expenses are cash rental rates. For farmland owners, higher rents result in more income. For farmland renters, higher cash rents are yet another expense trending higher.

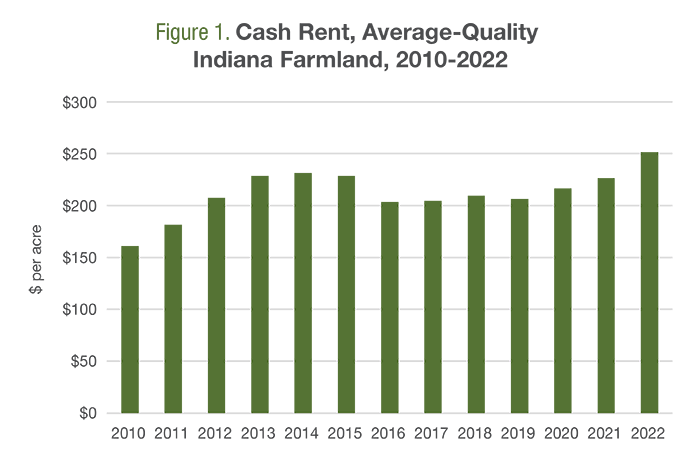

Dollars Per Acre

Figure 1 shows the cash rental rates for average-quality farmland in Indiana. While the level of cash rent paid varies greatly across the country, the general trend in recent years is similar. After rising to about $230 per acre between 2013 and 2015, cash rents fell to $205 per acre by 2016 because of lower commodity prices and farm incomes. In 2020, rental rates began increasing and again approached $230 per acre by 2021.

In 2022, rates peaked at $252 per acre. While it took nearly a decade for cash rental rates to exceed the previous high, these data alone don’t provide a complete summary of the situation.

Dollars Per Bushel

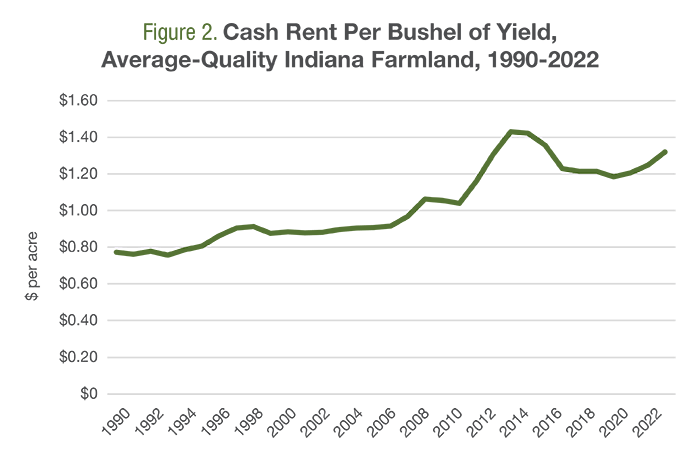

As we’ve written in previous columns, considering only dollars per acre distorts our thinking, especially when productivity changes are a factor. Corn yields, for example, nationally trend toward increasing by 2.1 bushels per acre per year. While the management implications may be negligible on a year-to-year basis, the effects are significant over a decade. So how do 2022 rental rates compare with rates from a decade ago, when budgeted yields were roughly 20 bushels lower?

Figure 2 shows the Indiana cash rent data per bushel of yield. On a dollars-per-bushel basis, cash rental rates remain lower than they were a decade ago. More specifically, 2022 rental rates were equal to $1.32 per bushel in 2022, compared to the high of $1.43 per bushel in 2013. Furthermore, per-bushel rents were higher than 2022 levels between 2013 and 2015.

Wrapping It Up

While it’s hard to say how much higher cash rental rates will be in 2023 and beyond, these data highlight two important management implications.

First, producers should avoid using just one measurement – corn per acre, cost per bushel, etc. – when considering how expensive or burdensome production expenses have become. While per-acre cash rental rates are at all-time highs, productivity gains have chipped away at the cost per unit of output sold. In other words, yield increases have offset some of the price sting.

Second, these data suggest the possibility of additional upward pressure on cash rents. Producers were paying more per bushel of anticipated yield the last time commodity prices were this high. In today’s terms, 2013 cash rents at $1.43 per bushel – $0.10 per bushel higher than current levels – equate to $273 per acre, more than $20 per acre (+8.5%) higher than current cash rents. This is some context surrounding the current situation, not a forecast of future cash rents.

Finally, rental rates and trends vary across commodities and geographies, but management lessons remain the same. During significant, rapid changes in revenue and expenses, insights from cost-per-acre and cost-per-bushel provide considerable value.

David and Brent are the co-founders of Ag Economic Insights (AEI.ag). Founded in 2014, AEI.ag helps improve producers, lenders, and agribusiness decision-making through 1) the free Weekly Insights blog, 2) the award-winning AEI.ag Presents podcast – featuring Escaping 1980 and Corn Saves America, and 3) the AEI Premium platform, which includes the Ag Forecast Network decision tool. Visit AEI.ag or email David (david@aei.ag) to learn more. Stay curious.

3 Min Read

- Cash rental rates peaked in 2022.

- Cash rental rates are lower now than a decade ago on a dollars-per-bushel basis.

- Data suggest possible upward pressure on cash rents.